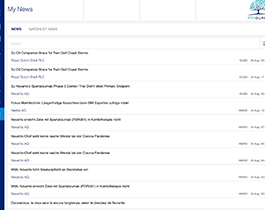

Relationship Management

All key details of your client relationship can be formalised within the tool. This will allow your immediate connectivity to all your clients during your regular catch ups or upon their contact.

All client interactions can be formalised efficiently as part of a contact report. Sensitive information can be segragated and kept confidential as part of the relationhip management overview.

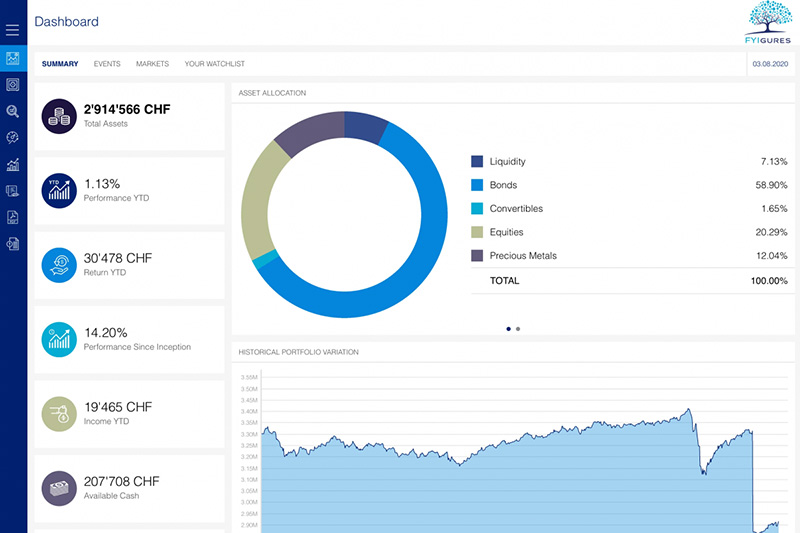

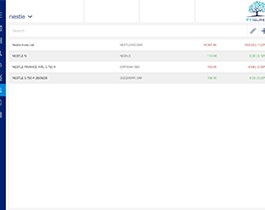

Portfolio Management

Immediate access to your clients’portfolios with real-time valuations. The decisions / advice to be taken / provided depends from the service model in place.

A timely portfolio management can provide your clients with the right opportunities based on their risk profile. The portfolio management represents one of the most important points of differentiation between asset managers and one of the key element to gain client satisfaction.

Mydesq allows an appropriate portfolio management in line with clients’ expectations and investment strategies.

Order Entry

The interface to enter a manual order is intuitive and fit for purpose. Order entry can be managed as a single order or a bulk order. Mydesq ensure that all orders created by the client are timely transferred to the custodians.

Mydesq ensures an appropriate automation of the clients’ constraints and blockages to ensure this process is performed efficiently and without mistakes by the Advisor.

Document Archiving

All clients’ and accounts’ documents can be safely stored in mydesq. This allows an appropriate link between the assets and the relevant documents.

The document validation is automated by Mydesq which ensure the systemic tracking of all documents at client, account and portfolio level.

All client’s documents are set up with an expiration date which trigger the appropriate notifications to the relationship manager. This allows the Advisor to plan in advance the document gathering with the respective client minimising interactions related to admin.

Portfolio Analysis

An extensive set of analytics allow an optimal overview of the portfolio from different perspectives. Immediate visibility on asset allocations, performances, liquidity, fees, etc. is available with few clicks and in real time.

The definition of SAA, TAA or portfolio model allows allow overview of deviations. The tool provide suggestions to realign the portfolio to the model.

Bulk orders and overview of the distribution of instruments accross all portfolios allows a coordinate management of all assets under management.

Client Reporting

With over 200 reports available and printable we are able to provide you with the necessary information to satisfy every clients’ request.

Every page and financial analysis available on the platform is printable and extractable in different formats. You can customized your reports and have them available for every client white labelled with your logo.

The perfect match of our reporting with every Bank statement allows you and your clients to get the same visibility of the financial situation available in several e-bankings with only one access to our platform.

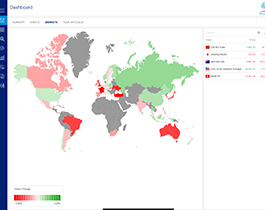

Product Shelf

Our market overview simplifies the connectivity to the market data available for all indexes and instruments. The real time update of investment valuations and market data ensure effective and quick investment decisions which could make the difference in terms of performances.

The platform supports also the direct management of key non-bankable assets like Private Equities, personal investments, luxury collectibles, etc..

Investment Suitability

Mydesq is fully aligned to the new regulatory requirements in terms of Suitability. Immediate alignement to the new regulation trends is ensured by an automated workflow and a set of forms digitally available to manage the clients.

The compairaison of the portfolio with a defined SAA or TAA or a Model Portfolio allow an instant overview and correction of any deviation from the investment strategy agreed with the client.

The integration of the suitability checks within the workflow ensure complete adherence to current regulations without any extra effort.

Investment Proposal

Mydesq support the preparation of Investment Proposals with both a bottom up and top down approach. The Investment Counsellor has only to choose is favourite approach to produce an investment proposal.

A digital workflow ensures the distribution of the investment proposal to the respective client and the direct collection of his feedback. This digitalised process increase efficiency by reducing the back and forth by email or by any other mean.

Client Onboarding

Change is not easy, but we will support you through the process. Learning a new system is not easy. But we assure you that we will save you a lot of time in the future.

We are not only software suppliers but also advisors and your right hand who will support you in every step of the implementation.Our objective is not only to deliver a software but help you optimize the way you operate.We will work for your satisfaction and till you see tangible benefits.

Compliance

Mydesq is perfectly aligned with the key regulations of the countries where we operate. The correct design of automated workflows can ensure the reduction of controls by keeping the same alignment to regulations

A dedicate module for your compliance officer supports the day-to-day monitoring and support provided to the relationship managers.

The availability of the right forms and reports drives successfuls preparation to audits to make them more efficient and less expensive.

Invoicing

All your fees and retros can be integrated within mydesq. The computation and the generation of all invoices is automated

Availability of invoice templates for both custodian banks and clients reduces the admin burden of your invoicing on a quarterly or yearly basis.

Customer Experience

Customer Experience

Reduce Administration

Reduce Administration

Digitalization

Digitalization

Overcome Regulation Hurdles

Overcome Regulation Hurdles

Process automation

Process automation

Cutting-Edge technology

Cutting-Edge technology

Client centric

Client centric